Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

India’s debt mutual funds (MFs) have been in a tough spot in recent months. With rising bond yields, and the consequent decline in NAVs, it is not surprising that investors are nervous. The heydays of this space, as seen during the rate cut cycle from December 2018 to May 2020, are over – at least for the foreseeable future.

But debt funds still have a role to play in investor portfolios, especially when it comes to managing liquidity or reducing volatility. Investors need to be better-informed about how the current scenario – where inflation is high and interest rates are expected to remain low – can impact allocation to debt funds.

We look at how the different debt fund categories are currently positioned in terms of risk-reward trade-off, and help identify the categories best-suited for various investment horizons.

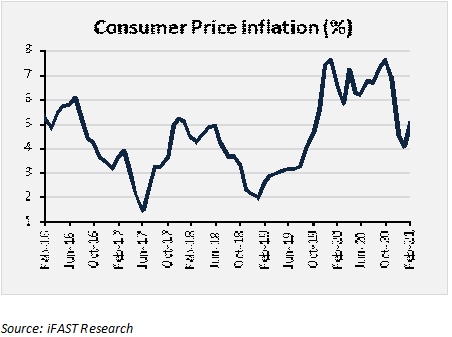

Rising inflation is a spoilsport

Inflation lowers real rate of return from fixed income assets. While rising inflation can be an indicator of high demand and faster economic recovery, too much of it can negatively impact growth prospects. For businesses, inflation leads to cost escalations, sluggish capex activity and a dip in profitability. It also impacts consumption as the focus shifts towards saving money instead of spending it. A combination of these factors, coupled with weak sentiments, hurts GDP growth.

We expect inflation to stay elevated in India as supply-side disruptions persist in the face of COVID-19 resurgence in many parts. The rising input/raw material prices across the globe, elevated fuel costs due to high taxes levied by central/state governments, and India’s high dependence on crude imports are all strong headwinds for policymakers seeking to control inflation.

With this outlook, we expect the returns on debt mutual funds to be subdued as well. The return reduces even further if one takes into account:

-Expense ratios charged on the funds

-Exit load (if acquired units are not held for longer than a specified period)

-Taxation (in case of redemption of units, systematic transfer plans and systematic withdrawal plans)

Interest rate risk depends on inflation

Interest rate risk represents the extent to which bond prices (and consequently the NAVs of debt MFs) decline due to the rise in interest rates. Longer the time till maturity of a debt instrument, the higher the interest rate risk associated with it.

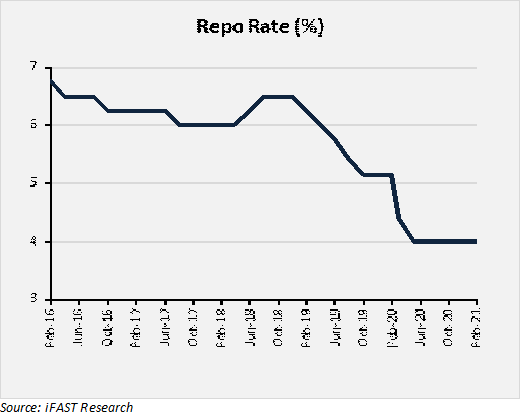

At a time when India’s inflation trend portrays an upward bias and economic activities are witnessing a strong rebound, the Reserve Bank of India (RBI) is unlikely to cut rates lower than current levels. A transient increase in inflation in the upcoming months may not lead to a rate hike either. Policy makers would not want to increase the cost of borrowing at a time when the economic recovery is at a nascent stage. In this case, a combination of paused rates and steep inflation can restrict the upside potential of bond instruments.

However, if inflation goes beyond the RBI’s upper target band of 6 percent for an extended period of time, it may force the central bank to reconsider its accommodative stance and increase the Repo rate. This could trigger volatility in NAVs of debt MFs, with the categories investing in long-term debt instruments bearing higher interest rate risk.

At this point, we believe that a long-pause-in-rates scenario will prevail for a while.

Gilt funds have chinks in their ’zero credit-risk’ armour

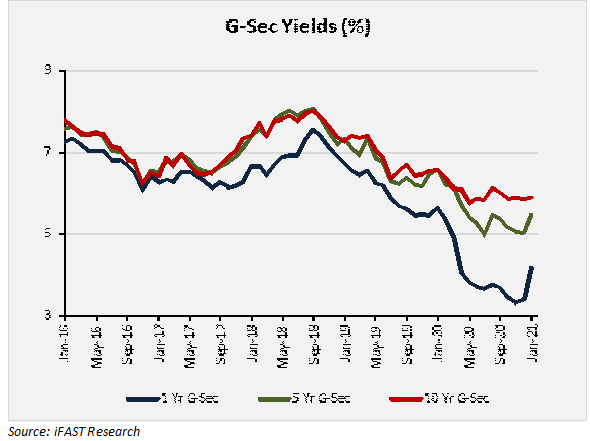

We expect the yields on government bonds to trend upward, driven by the high fiscal deficit and planned borrowing programme in FY22. The anticipation of higher supply of government securities in the market has led to a steepening of the yields in the case of gilt MFs, especially those that invest at the longer end of the duration curve.

Since bond prices and yields have an inverse relationship, higher yields lead to lower bond prices. This, in turn, will have a noticeable impact on NAVs of debt MF categories such as gilt funds, gilt funds with 10-year constant maturity and other categories that invest heavily in medium to long-term gilts.

Which debt fund categories should investors prioritize

The kind of returns seen in debt mutual funds in 2019 and the first half of 2020, when the RBI was in a rate-cut mode, will not be seen anytime soon. Investors need to evaluate the role of debt funds in their portfolios, and focus on allocating to funds whose NAVs will be less volatile to interest rate risk. Consequently, categories that invest at the short to medium end of the duration curve should be given preference.

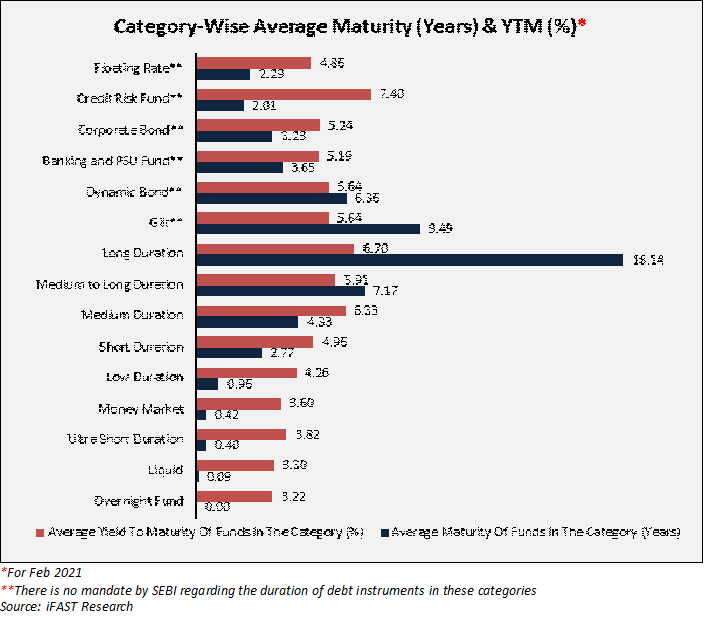

When initiating fresh investments, or reviewing existing ones, investors need to look at yield to maturity (YTM), which represents expected return from a debt mutual fund. YTM tends to be high if interest rate risk and/or credit risk of the fund is high. Chasing high YTM categories can expose an investor to high volatility in NAVs – more so when the interest rate cut cycle has already played out.

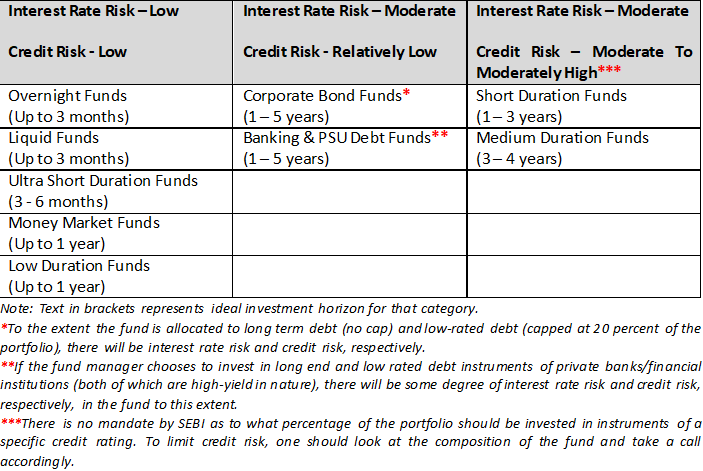

As the chart illustrates, debt fund categories that invest at the longer end of the duration curve are not advisable at the moment since they carry higher risk. For those who wish to invest in long-term debt, dynamic bond funds can be a suitable option vis-à-vis investing in standalone long-term debt MF categories. High interest rate risk associated with longer duration debt instruments in the portfolio will be offset by short and medium duration debt instruments, which carry relatively lower interest rate risk.

Furthermore, given the fragile nature of economic recovery, we don’t recommend taking high credit risk just yet. Credit risk funds, which, by SEBI mandate, are required to invest minimum 65 percent of their portfolio in debt instruments that are not highest rated, can be avoided by most investors.

In conclusion, the following are our most preferred categories of debt funds in the current scenario.