Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

You couldn’t have escaped some of these statements in the recent past: The market has tanked, the GDP figures were disappointing. Another few hundred points down, the rupee is going to sink more; inflation figures are going to be bad. Sure, the disappointment in the tone and falling economic indicators must have caught the attention of every investor. But what most have missed is that the market is increasingly getting influenced by economic indicators and events — that too in faraway lands — in a big way.

Consider, for example, how the market danced to US Federal Reserve’s decision to continue with monetary easing or how it reacted to the appointment of the new Reserve Bank of India governor or his maiden policy. Sure, such events always influence markets, but the magnitude is something new. And, they have implications for your financial plan, including short-term as well as long-term goals. "Some economic indicators like inflation and exchange rate impact an individual’s finances directly while others like GDP growth rate give an idea of where the economy is headed.

Therefore, it is important to keep a close eye on the developments in this space. Also, all these events cannot be seen in isolation. It is their collective impact that needs to be taken into account. While individuals should not tweak their long-term financial plan on the basis of changes in the scenario in the short term, they can make adjustments once in a year. We advise our clients to review their portfolio annually and factor in the economic situation in the country," says certified financial planner Suresh Sadagopan, founder, Ladder7 Financial Advisories.

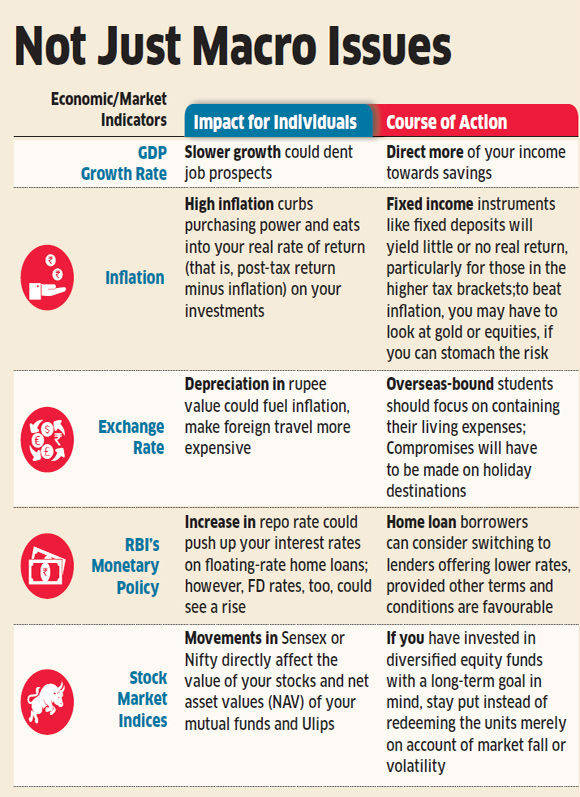

Read on to understand the impact of five such factors on your financial life:

GROSS DOMESTIC PRODUCT (GDP)

You must be familiar with opinion pieces that talk about how India, after witnessing the highs of over 8-9% growth in the previous decade, is crawling at a growth rate of just under 5% now. Ratings agency Crisil, in a report released recently, said the growth estimate has been reduced to "a decade-low of 4.8%" for 2013-14. In simple terms, the Indian economy is expected to continue to be sluggish. Slower growth, thus, dents job prospects, forcing many to rein-in their aspirations and reset the timelines of their financial goals. "Downbeat economic conditions mean that jobs are hard to come by and one should focus more on saving at this point of time," explains Madan Sabnavis, chief economist of CARE Ratings.

INFLATION

Given that price rise has been the one of the chief causes of governments being voted out of power in the past, it would be safe to assume that even laypersons are aware of how inflation — rate of growth in prices — affects their consumption spends. From an individual’s perspective, the consumer price index (CPI) and food inflation are more relevant than the wholesale price index (WPI) inflation. As per the figures released by the commerce ministry, CPI inflation for August 2013 is down to 9.52% from 9.64% in July. Wholoesale price inflation, on the other hand, inched up from 5.79% in July 2013 to 6.1% in August. Food items were costlier by 18.8%, compared to the same period last year.

"Inflation (especially food inflation) is close to any individual’s heart as this indicator decides the allocation of salary towards food, other items of necessity and luxury, and finally the allocation towards savings," says Indranil Pan, chief economist at Kotak Mahindra Bank. However, not many understand its impact on their savings and investments. "It helps you ascertain whether your portfolio is giving you real returns. For example, a bank deposit may fetch 9% return for the year. If you are taxed at a marginal rate of tax of 20%, then post-tax, your return would be 9% - (20% x 9% = 1.8%) = 7.2% pa.

Now, this is the nominal rate of return your money earns, post tax. If inflation is at 8% per annum that year, then effectively you have earned a real rate of return (nominal rate of return - inflation rate) of -0.8% (7.2% - 8%).

Here’s how economic indicators can affect your financial life This means that your capital has actually been eroded," says Aditya Apte, partner with investment advisory firm, The Tipping Point. The post-tax returns of traditional products like bank FDs and national savings certificates are not capable of beating inflation. "In inflationary times, one may look at stocks or gold as a hedge against inflation," advises Sabnavis.

RBI’S MONETARY POLICY

The Reserve Bank of India, through its policy measures, influences the interest rate movements in the market using several tools at its disposal, including repo and reverse repo rates. Any action on this front directly impacts interest rates in the system, which in turn affect your home loan or fixed deposit rates. For instance, a hike in the repo rate could push up the interest rates on your loans and also deposits. Therefore, it is important to understand the implications of changes in policy rates. "This helps us understand at what rates RBI is willing to lend and borrow from banks. This, in turn, helps us gauge if banks will provide cheaper loans going ahead or will they become more expensive. This can help individuals plan long-term money commitments, which require loans or mortgages, better," says Apte.

EXCHANGE RATE

Though it is now hovering around the Rs 62-levels, the freefall of the rupee, which has depreciated by around 15% since May visa-vis the US dollar, has been the subject matter of a number of news reports, analyses and, of course, jokes. On Tuesday, the rupee ended at Rs 62.46 to the US dollar. (The financial markets were closed on Wednesday because of a public holiday.) For individuals, the immediate impact is seen in the form of rise in inflation. "While the effect is rupee depreciation, the cause will be the current account deficit (CAD). And, CAD is a mirror image of the fiscal deficit that the economy is facing. Further, a high fiscal deficit and a high CAD that lead to currency depreciation would eventually lead to inflation pressures," explains Pan. A diminishing rupee adds to the expenses of travelling abroad, particularly the US — be it for leisure, business or studies. Moreover, it adversely impacts corporate earnings, barring export-dependent sectors like IT, taking a toll on your equity investments. "Exchange rate affects plans to study abroad, go on holiday, air fares and so on," says Sabnavis.

STOCK MARKET INDICES

An indicator of the economic situation and the level of business confidence in the country, any rise or fall in Nifty or Sensex is directly reflected in your equity investments — stocks or mutual funds — on a daily basis. Moreover, they give a sense of where the economy is headed. "These indices are keenly watched by investment professionals, as they tend to be the barometers of economic conditions in the industry and hence, the economy as well," says Apte.