Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

Apart from tax deducted at source (TDS), the government collects taxes on a quarterly basis in the form of advance tax before the end of a financial year, ensuring constant flow of tax revenue during the year rather than at the year-end. This also reduces the burden on taxpayers as the tax liability can be discharged through quarterly payments, resulting in smaller cash outflows.

Paying in instalments

From Finance Act 2012, a resident senior citizen (age of sixty years or more at any time during the financial year) is exempted from making payment of advance tax unless such person derives income from business or profession.

For the calculation of advance tax, taxpayers are required to estimate their total taxable income and income tax (including applicable cess and surcharge) for the entire financial year. From this estimated tax liability for the year, taxes discharged by way of withholding, foreign tax credit and earlier advance tax instalments paid if any, need to be deducted. Specified percentage of this remaining tax is payable on or before the specified due dates.

It is worthwhile to note that the estimated tax liability should be revisited at regular intervals to ensure that correct taxes are deposited by way of advance tax to avoid penal interest.

Advance tax can be paid online or offline by using Challan ITNS 280 (ticking the relevant column, i.e., Advance Tax).

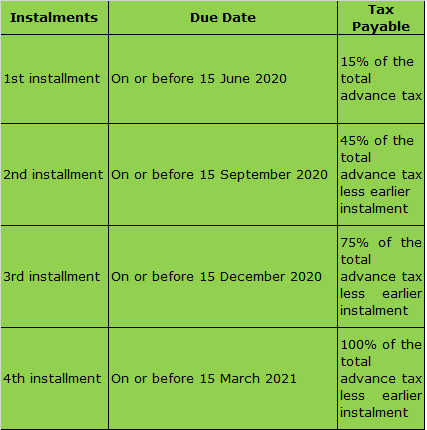

The due dates for payment of advance tax by individuals for FY 2020-21 and the amount payable (plus applicable surcharge and cess) are:

The amount paid after March 15 but on or before March 31 is also treated as advance tax paid. Thus, if the estimated income is likely to exceed the amount estimated on or before March 15, then additional advance tax can be paid and penal interest can be reduced.

Interest and penalty

Interest at 1 per cent a month is levied for three months in the case of deferral of tax payment, which is due on June 15, September 15 and December 15, and for one month in the case of deferral of payment of the last instalment, i.e., tax that is due on March 15.

However, it is pertinent to note that interest is not payable if the advance tax paid

-On or before June 15 is 12 per cent or more of the tax due for the year;

-On or before September 15 is 36 per cent or more of the tax due for the year.

Further, as income from capital gains cannot be anticipated, advance tax on capital gains becomes payable starting from the quarter in which the capital asset is sold. Therefore, no interest is charged in respect of advance tax on capital gains if the tax on such income is paid in subsequent instalments due when the gain arises before March 15; if such a gain arises after March 15, no interest will be charged if the tax is paid on or before March 31.

If the total amount of advance tax paid amounts to less than 90 per cent of the taxpayer’s advance tax liability, interest is payable at the rate of 1 per cent per month from April 1, following the year in which the tax is due, until balance payment of the tax.

COVID disruption

The economy is facing an unprecedented disruption and uncertainty due to the COVID-19 pandemic. The government has announced some relief in response to the same. One such relief is reducing the interest liability on tax payments falling due between March 20 and June 29, but paid by June 30, 2020.

The first instalment of advance tax is due by June 15, 2020, and if it is paid by June 30, 2020, the interest on delayed payment of such taxes will be levied at 0.75 per cent a month, instead of 1 per cent a month.

To summarise, if the first instalment of appropriate advance tax is paid by

-June 15, 2020, there will be no interest levied

-June 30, 2020, reduced interest will be levied at 0.75 per cent per month, instead of 1 per cent a month

-After June 30, 2020, interest will be levied at 1 per cent a month.

You expressly agree the use of the service is at your sole risk. The service is provided on an "as is" and "as available" basis. www.surojitkala.com expressly disclams all warranties of any kind, whether express or implied, including, but not limited to the implied warranties of merchantability, fitness for a particular purpose and non-infringement. www.surojitkala.com makes no warranty the services will meet your requirements, or the services will be uninterrupted, timely, secure, or error free. Nor does www.surojitkala.com make any warranty as to the results that may be obtained through the service or that defects in the software will be corrected. You understand and agree any material and/ or data downloaded or otherwise obtained through the use of the service is done at your own discretion and risk and you will be solely responsible for any damage to your computer systems or loss of data that results from the download of such material and/ or data. www.surojitkala.com makes no warranty regarding any goods or services purchased or obtained through the service or any transactions entered into through the service. No advice or information, whether oral or written, which you obtain from www.surojitkala.com or through the service shall create any warranty not expressly made herein.

You acknowledge that www.surojitkala.com site may contain links to other web sites operated by third parties ("linked sites"). You acknowledge that, when you click on a link to visit a linked site, a frame may appear that contains the www.surojitkala.com logo, advertisements and/ or other content selected by www.surojitkala.com. You acknowledge that www.surojitkala.com and its sponsors neither endorse nor are affiliated with the linked site or any link contained in a link site, or any changes or updates to such sites. You also acknowledge that www.surojitkala.com is providing these links to you only as a convenience.

www.surojitkala.com does not endorse in anyway any advertisers/ contents of advertisers on its webpages. Please therefore verify the veracity of all information on your own before undertaking reliance and actioning thereupon. www.ecrwealth.com shall not be responsible nor liable for any consequential damages arising on account of your relying on the contents of the advertisement.

This site is the responsibility of www.surojitkala.com

We want you to

What Information is, or may be, collected from you?

We will collect certain anonymous information in standard usage logs through our Web server, including: computer-identification information obtained from "cookies," sent to your browser from a

We may collect the following personally identifiable information about you:

Who collects the information?

We will collect anonymous traffic information from you when you visit our site

We will collect personally identifiable information about you only as part of a voluntary registration process.

Our advertisers may collect anonymous traffic information from their own assigned cookies to your browser

The Site contains links to other Web sites. We are not responsible for the privacy practices of such Web sites

We offer a collection of online services which are available to you. Please understand that any information that is disclosed in these areas becomes public information. We have no control over its use and you should exercise caution when disclosing your personal information to anyone.

How's the information used?

We use personal information to:

We use contact information internally to:

Generally, we use anonymous traffic information to:

With whom will your information be shared?

We will not disclose any of your personally identifiable information to third parties unless:

We will not use your financial information for any purpose other than to provide services to you.

What choices are available to you regarding collection, use and distribution of your information?

Supplying personally identifiable information is entirely voluntary. You are not required to register with us in order to use our site. However, we offer some services only to visitors who do register.

Upon request, we will remove your personally identifiable information from our database, thereby canceling your registration.

If we plan to use your personally identifiable information for any commercial purposes, we will notify you at the time we collect that information and allow you to opt-out of having your information used for those purposes.

All sites that are customizable require that you accept cookies. You also must accept cookies to register as someone for access to some of our services. e.g Online Portfolio. For information on how to set your browser to alert you to cookies, or to reject cookies, go to http://www.cookiecentral.com/faq/.

What security procedures are in place to protect information from loss, misuse or alteration?

To protect against the loss, misuse and alteration of the information under our control, we have in place appropriate physical, electronic and managerial procedures. For example, our servers are accessible only to authorized personnel.

Although we will endeavor to safeguard the confidentiality of your personally identifiable information, transmissions made by means of the Internet cannot be made absolutely secure. By using this site, you agree that we will have no liability for disclosure of your information due to errors in transmission or unauthorized acts of third parties.

Policy Updates

We reserve the right to change or update these policies at any time upon reasonable notice, effective immediately upon posting to this site.

Industry News

Industry News